Jigsaw daytradr™ – an award winning, unique & innovative order flow and trade execution platform.

Scroll Down for a breakdown of our unique set of features.

Trading Software Overview & Compatibility

There are 2 different versions of the tools:

1 – Daytradr Trading Platform™

Note that the GAIN Feed is also known by the following names: Alpha Trader, Apex Trader, ATC Trader, CTG Pro, DT Pro, G-Force Trader, Global Zen Trader, High Ground Trader, Index Trade Launcher, S5 Trader & Zaner 360.

2 – Jigsaw Bridge™/Plug-in

Our award winning tools can integrate to your existing trading platform. The Jigsaw Platform Bridge™ allows daytradr to connect directly with the NinjaTrader 7/8 and MetaTrader 5 platforms as well as MultiCharts.NET and MultiCharts.NET SE.

daytradr Charts

Jigsaw “LTF” Charts

Jigsaws “LTF” Charts is an innovative full charting package made to work “out of the box” with minimum need for user settings or complex setup. We added traditional charts to our Order Flow package in response to tightening of regulations by the CME that sees your data fees increase dramatically if you connect from 3 or more apps. This is a charting tool for traders, it is not meant to be a huge and complex tool with thousands of options per chart and indicator. That’s been done elsewhere and we aren’t trying to do what everyone else is doing or compete with “tools you tinker with forever”. This is what 99% of people need from their charting “with as few clicks as possible”.

We started with “LTF” – Lower Time Frames – or those below the daily timeframe. More timeframes and charts are on the way. Watch the video to the left to see what’s included.

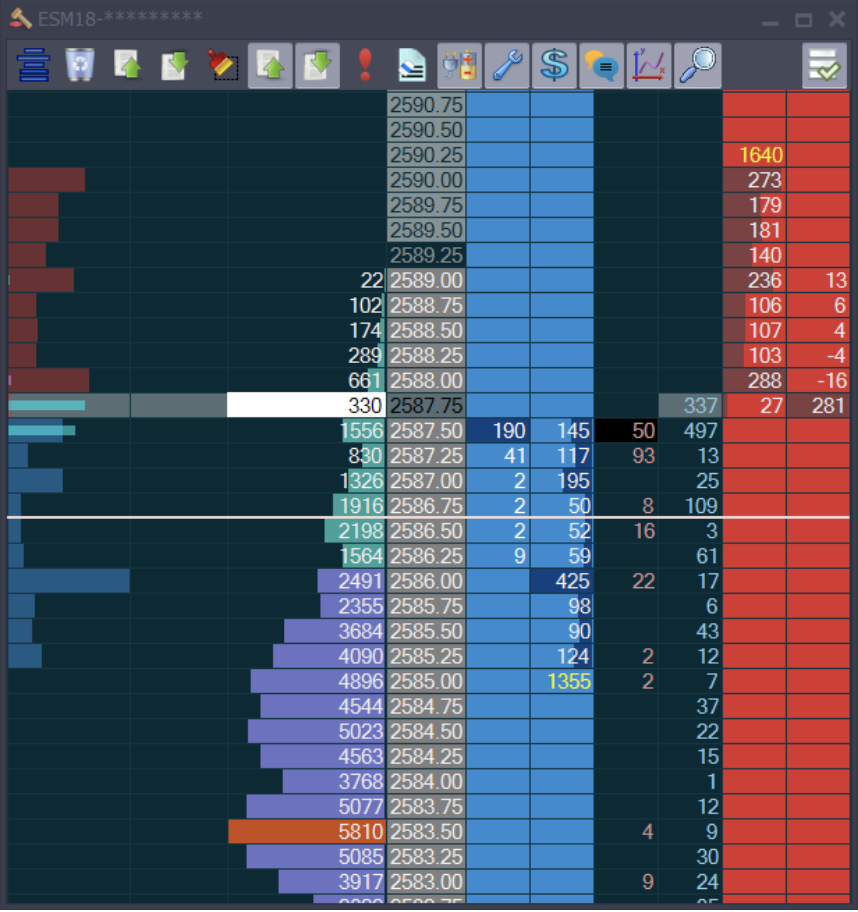

Depth & Sales (Depth of Market)

The Depth & Sales shows:

- The impact of trades hitting the market

- Where traders are getting stuck

- Likely location of stop orders/where traders are positioned

- Where traders are pulling(cancelling) their orders, to avoid a move

- Where traders are stacking (iceberging) and front-running the market in anticipation of the market holding

- Balance of trade/momentum

- Alert column for pre-market notes

- Integration to JS Services Desktop

- Order Queue Position

- Trade P&L Per Price

The Depth & Sales is also your primary order entry tool, with one click trading, automated exit strategies, auto order types, volume based stops, and the overall feel of an execution tool that could only have been developed by a fellow trader.

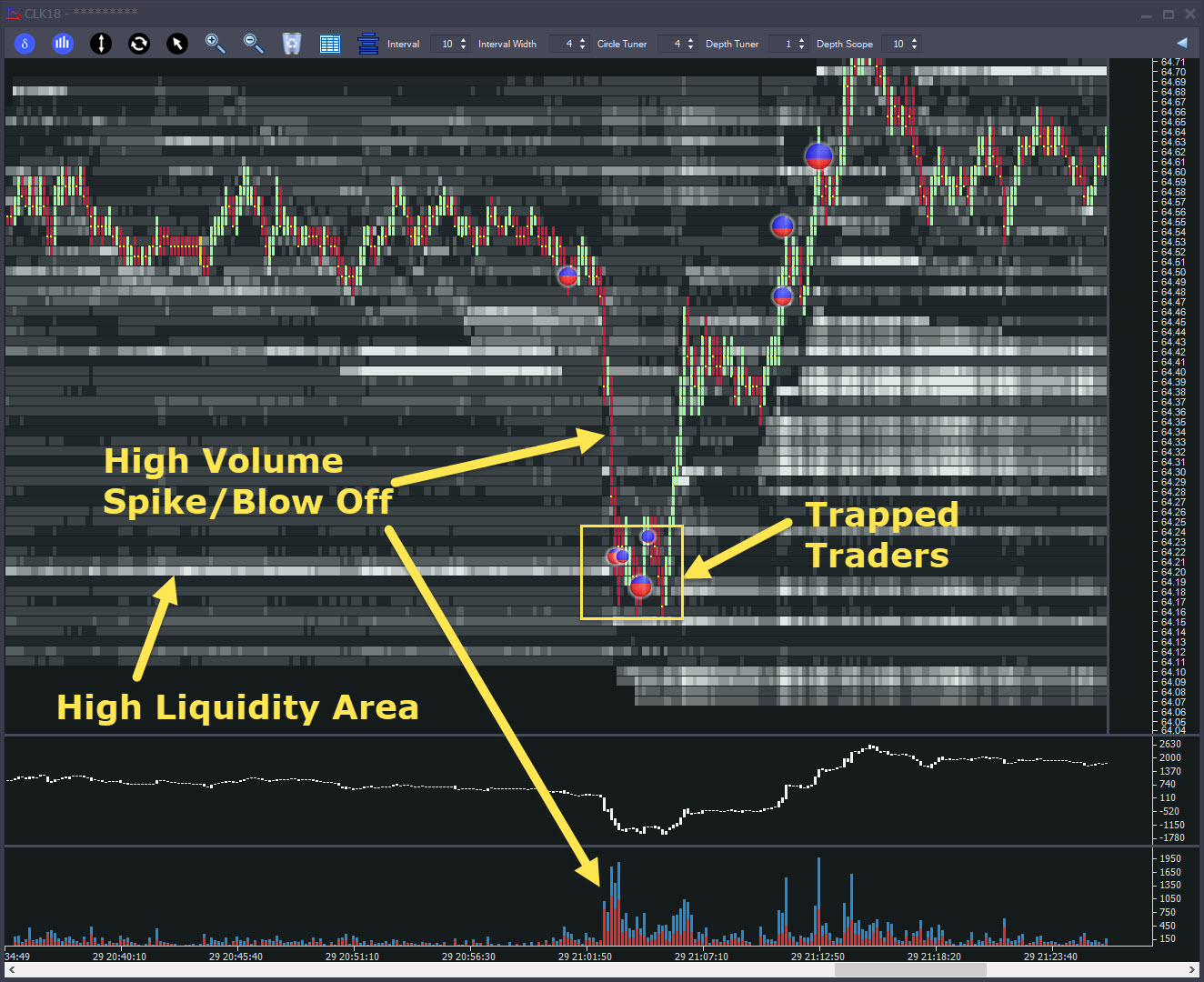

The Auction Vista – Order Flow History

Auction Vista gives a detailed view of both real time and historical order flow. An extremely accurate ‘self tuning’ view with very few settings required to get the most from it.

- Market Depth visualization – the shaded background contains lighter areas show us where liquidity exists. This is not a guarantee of the market holding but a heads up that other traders are interested in that area. As price approaches, we look for front running by other trader or for the liquidity to be pulled out of the way.

- Large Trade Circles – our proprietary algorithm, reveals areas of high volume that trade at a level over time. Time and time again, these circles pinpoint key areas such as the end of a volume blow off, iceberg orders and market turning points.

- Trade From Chart – Manage your trades directly from the chart.

- Price Delta Chart, Cumulative Delta, Volume Delta Bars, Depth Histogram and Flip Charts make this the most complete Order Flow chart on the market.

Trade Simulator

Learning to trade or learning a new strategy is problematic on most trade platforms. Unless you are trading live, with real money – you’ll never know how realistic the results are. That’s because most platforms take an optimistic view on the prices you’d be filled at. Jigsaw daytradr is different – it gives you realistic fills on Limit Orders and realistic slippage on Market and Stop Orders.

So whether you are learning to trade OR trying out a new strategy, the Jigsaw Trade Simulator gives you a much more realistic set of results.

Jigsaw Simulator

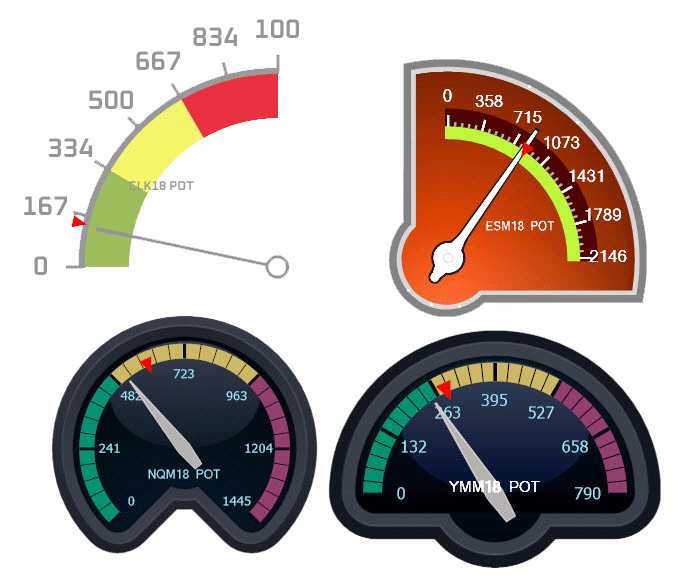

Smart Gauges

The Pace of Tape (PoT) Smart Gauge comes in over 50 styles and gives you an easy to absorb view of the pace of trading in a market relative to recent historical average.

The most obvious use of this is to see the change in trading activity at key inflection points (e.g. support & resistance levels) in the market. Less obvious uses are in helping to gauge the strength of a pullback, the chances of a market breaking out and in trade management. These are all uses of the pace of trade used by institutional day traders every day.

A slightly different use but equally beneficial is monitoring the pace of correlated markets. For example, if S&P, Nasdaq and DOW Futures are all lively – you have more chance of follow through. If only your market is lively but the other 2 quiet, it’s more likely any move will soon fade.

In addition to this, we also have meters for:

- Market Depth

- Order Book pulling/Stacking

- Trades (all trades, trades since opening a position, trades in past n seconds, filtered trades)

- Jigsaw Pace of Tape

And Much More

There’s too many great features to list that aren’t on this page but for the really curious, you can take a look at the product manual.

Here’s a list of other things to look out for :

- Reconstructed Tape – Time & Sales on steroids!

- Order Flow Event Alerts (iceberg alert, block trade alert, large trade alert, divergence alert)

- Innovative workspace management

- Position and Orders analysis window – with direct trading interface

- Custom Trading Sessions

- Automatic Symbol Download

- Exchange Traded Spread Support

- Equity Support (NASDAQ L2)

- Global Market Support – e.g. US, Europe, Hong Kong, Sydney, Osaka (additional markets added on request)

Copyright Jigsaw Trading © 2024

Privacy Policy

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Jigsaw Leaderboard

Note that the Jigsaw Leaderboard contains a mixture of SIM/Live Traders. For many traders, you can click by their name to see the trades along with the SIM/Live designation.

The following is a mandatory disclaimer for SIM Trading results: